Commercial Property Market Review – September 2025

| City investment volumes reached £2bn by July, 33% below average, but deal sizes are notably larger | The outlook for H2 2025 is brighter due to improved credit and stabilising investor confidence in offices and industrials | London construction faces pipeline contractions, though government-backed infrastructure projects show some momentum |

City investment market update

The latest statistics from Savills offer an insight into the City investment market.

In July, the market recorded £197.6m of transactions across six deals. One of these marked the seventh deal over £100m in 2025, already beating 2024’s total of four large transactions across the whole year, suggesting renewed investor appetite for larger lot sizes.

Between January and July, total turnover in the City investment market reached £2bn across 42 transactions, which is 33% lower than the five-year average. However, the average deal size is currently £47.6m, significantly higher than the average of £23.6m recorded this time last year.

At the end of July, there was £2.05bn of commercial property under offer across 41 transactions. There is £1.9bn of stock currently available, with more expected to come on the market in September following the usual summer holiday slowdown. Meanwhile, the Savills City prime yield remains at 5.25% for the twenty-fourth consecutive month.

A stronger H2 for commercial property?

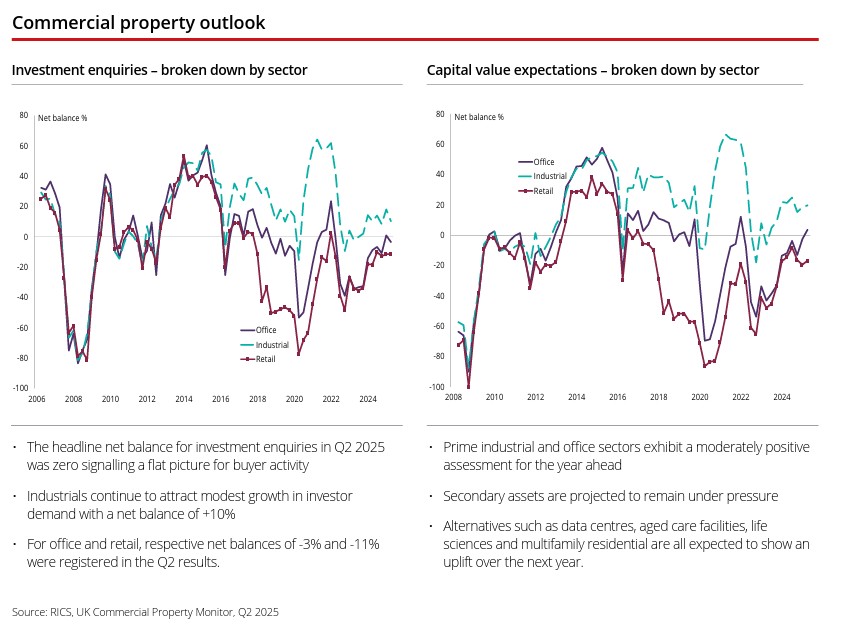

The UK commercial property market had a subdued start to the year, but the outlook for H2 is stronger.

According to CBRE, investment volumes in the first half of 2025 were down 18% when compared with H1 2024. Figures from Savills supported this, with overall volumes 7% lower than the long-term H1 average. The slowdown is likely due to widespread economic and geopolitical uncertainty, including inflation, trade tariffs and global conflict. As a result of these ongoing concerns, investors are generally concentrating on the office and industrial sectors, with limited activity outside of these areas. Office yields are at attractive levels considering interest rate levels, which are helping to attract investors.

Market experts anticipate that the second half of the year will be a little brighter for commercial property. Expectations of further cuts to Bank Rate should boost investor confidence, along with improved credit conditions and some anticipated economic clarity.

London construction market faces challenges

A report from Arcadis has found that the London new build pipeline contracted by nearly 30% in Q2, despite some big infrastructure orders at the start of the year.

According to the latest London Office Crane Survey, construction activity in the capital hit the lowest level since summer 2022, with 2.4 million sq. ft. added to the pipeline in the six months to the end of March.

There are some signs that the construction pipeline is regaining momentum, albeit slowly. Public non-housing output increased by 16% year-on-year in Q2, driven by government-backed health, research and infrastructure projects. As this sector only accounts for 10% of new build work it is not enough to drive recovery on its own.

Simon Rawlinson at Arcadis said, “Economic headwinds and the complexity of delivering major programmes continue to hold back recovery. But for those willing to invest now, opportunities remain.”

Quality over quantity for Scottish investors

Investors in the Scottish commercial market appear to be more selective, opting for fewer deals that are higher in value.

According to Knight Frank, there were 59 commercial property transactions in Scotland in the first half of 2025. The average deal size was £12.7m, which is 24% more than the average for 2020-2024 and the highest level in several years. Investment interest is focused on Scotland’s main cities, particularly Edinburgh, where the average deal size has increased by 84% to reach £26.3m. Glasgow saw a rise of 38% to £15.5m, while the typical deal in Aberdeen increased by 4% to £7.3m. However, outside these three cities, the average deal size fell by 52% to £3.2m.

Head of Scotland Commercial at Knight Frank, Alasdair Steele, commented on the findings, “There is a clear shift in preference among investors towards quality assets in the best locations – generally speaking, city centres.”

All details are correct at the time of writing (17 September 2025)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission